Table of Contents

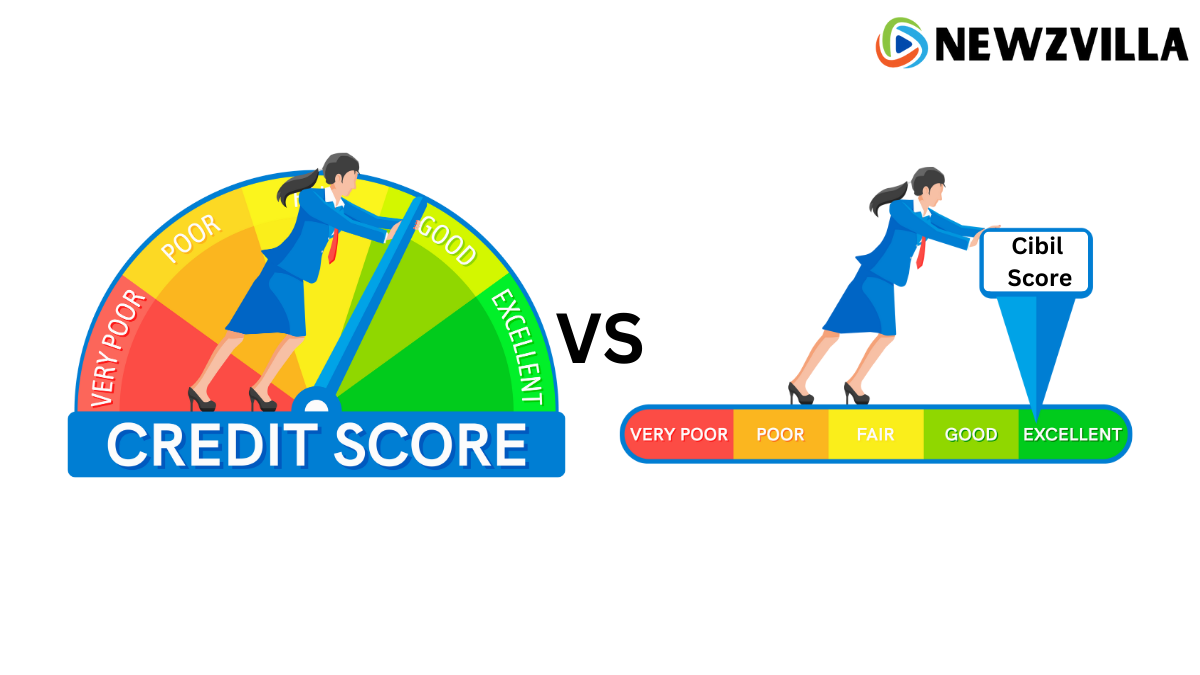

Difference Between Credit Score And CIBIL Score Navigating Credit Score

Alright, imagine your financial life is like a report card, and there are two scores involved – credit score and CIBIL score. They’re like siblings, but why the different names? Well, that’s what we’re here to unravel in the simplest way possible.

Picture this: your credit score and CIBIL score are like grades for how you handle money. Confusing, right? Don’t worry; we’re breaking it down. So, join in as we explore the world of these scores, making the whole money thing a bit less puzzling. It’s like figuring out your financial superhero status, and we’re here to guide you through it!

Introduction: The Crucial Role of Credit Health

A person’s credit health is a critical factor that financial institutions consider when they decide whether to extend credit. It impacts the prospects of getting a loan or credit card and the terms, such as the interest rate offered.

Understanding Credit Scores

What is a Credit Score?

A credit score is a numerical expression based on a level analysis of a person’s credit files, to represent the creditworthiness of that person. It’s a statistical number that evaluates a consumer’s creditworthiness.

Factors Influencing Your Score

Your credit score is influenced by many factors, including your payment history, the total amount of debt you carry, the types of credit you use, and the length of your credit history.

CIBIL Score Unveiled

Introduction and Significance

CIBIL score, or TransUnion CIBIL score, is a three-digit number ranging from 300 to 900. It’s a credit score provided by the Credit Information Bureau (India) Limited. The score indicates a person’s creditworthiness and is used by lenders to assess the risk associated with providing loans to the individual.

Comparison: Credit Score And CIBIL Score

Critical Differences in Reflecting Creditworthiness

While credit score and CIBIL score essentially convey the same information about an individual’s creditworthiness, the critical difference lies in who calculates the score. Various credit bureaus can calculate a credit score, while the CIBIL score is a specific credit score calculated by the Credit Information Bureau of India Limited.

Table: Comparison Between Credit Score and CIBIL Score

| Aspect | Credit Score | CIBIL Score |

| Definition | A statistical number that evaluates a consumer’s creditworthiness. | A specific type of credit score calculated by the Credit Information Bureau of India Limited. |

| Range | Typically ranges from 300-850 in the U.S. (varies by credit bureau and country). | Ranges from 300-900. |

| Calculation | Calculated by various credit bureaus based on credit history, types of credit, etc. | Calculated by the Credit Information Bureau (India) Limited based on similar factors. |

| Usage | Used globally by lenders to determine the risk level of lending to an individual. | Used specifically by Indian lenders to determine creditworthiness. |

Strategies for Improvement Credit score and CIBIL score

Tips for Boosting Your Credit score and CIBIL score

Improving your credit score involves managing debt responsibly over time. Pay your bills on time, keep your credit balances low, and don’t close old credit cards, even if you don’t use them anymore.

Personalized CIBIL Techniques

To improve your CIBIL score, review your credit report for any errors and get them corrected. Maintain a healthy credit mix, and avoid applying for credit unless necessary. Remember, a high CIBIL score can help you secure loans at more favorable interest rates.

How to Increase CIBIL Score Instantly?

Video: https://youtu.be/OPa923_WDhM?si=JBCEUCodQuRoh2MS

Future of Credit Scoring: Technological Innovations and Evolution

The future of credit scoring is set to be revolutionized by technological advancements. Big data analytics and machine learning algorithms are poised to offer a more holistic and accurate assessment of an individual’s creditworthiness. Innovations like blockchain could drastically enhance the security and reliability of credit data. Here’s a comparison of traditional and emerging credit assessment methods:

| Aspect | Traditional Methods | Emerging Methods |

| Assessment | Based on credit history and financial behaviour. | Incorporates non-traditional data (social media, spending habits). |

| Technology | Relies on manual data collection and processing. | Utilizes big data analytics, AI, and machine learning. |

| Speed | Time-consuming due to manual processes. | Instant decision-making enabled by real-time data processing. |

Wrapping Up: Navigating the Credit Health Landscape

Understanding the intricacies of credit health, be it your credit score or CIBIL score, is not just a necessity but an essential life skill in today’s financial landscape. It empowers you to make informed decisions and opens up a world of opportunities by offering access to better loan terms, interest rates, and even job prospects. In the face of technological evolution, we anticipate the emergence of even more robust, rapid, and accurate credit scoring systems, revolutionizing how we perceive financial credibility. So gear up, embrace financial literacy, and embark on the journey to improve your credit health today. Remember, a credit-wise individual is always ahead in the economic game. Empower yourself, and let your credit score open doors to various possibilities!

Frequently Asked Questions (FAQs) About Credit score and CIBIL score

1. What is the difference between a credit score and a CIBIL score?

A credit score is a general term for a statistical number evaluating an individual’s creditworthiness, calculated by various credit bureaus. A CIBIL score, on the other hand, is a specific type of credit score generated by the Credit Information Bureau (India) Limited, used by Indian lenders to determine the risk of lending to an individual.

2. How can I improve my credit score and CIBIL score?

Improving a credit or a CIBIL score involves managing debt responsibly over time. Paying bills promptly, maintaining low credit balances, keeping old credit cards open, and avoiding unnecessary credit applications are all effective strategies. Additionally, it’s essential to regularly check credit reports for errors and maintain a balanced mix of credit.

3. What role does credit history play in determining credit scores?

Credit history is a crucial factor in determining credit scores. It represents your past behaviour in handling credit and is used by lenders to gauge how likely you are to repay your debts. A credit history demonstrating timely repayment of debts, responsible credit utilization, and a balanced mix of different types of credit can contribute to a higher credit score.

![Newzvilla Maruti eVX Electric SUV to Feature Dual Screens and Rotary Dial [Video].](https://newzvilla.co.in/wp-content/uploads/2024/04/Screenshot-2024-04-04-212840-551x431.png)

Leave feedback about this